Terms and Conditions:

Troth Insurance Broking & Consultants Pvt. Ltd operates the website http://troth.co.in to provide consumers choice and an easy way to buy insurance products from multiple insurance companies (insurers). Troth Insurance is not an insurance company. Troth Insurance is a licensed insurance broking company holding a broking license from the Insurance Regulatory and Development Authority of India (IRDAI) with the Direct Broker Code: IRDA/DB 808/06/20.

Our participating insurance providers supply some of the information available on the website and therefore there may be inaccuracies in the website information over which Troth Insurance has limited control.

Troth Insurance does not warrant or guarantee the timeliness, accuracy, and completeness of the website information, or the quality of the results obtained from the use of the website.

To the maximum extent permitted by law, Troth Insurance has no liability concerning or arising out of the website information and website recommendations. You are responsible for making the ultimate decision about your purchase, and you should read all of the information provided before proceeding. If you have any questions about a product or its terms, you should seek further advice from Troth Insurance or the appropriate participating insurance provider before making your decision.

Troth Insurance may pass on your personal information to the relevant insurance participating provider if you apply to purchase a product through http://troth.co.in However, Troth Insurance does not guarantee when or if you will acquire the product that you have chosen. Troth Insurance does not accept any liability arising out of circumstances where there is a delay or decline in acquiring the product you have chosen.

Please note that Troth Insurance is only collecting or assisting the premium deposit on behalf of the insurer you have chosen to buy the policy from. The acceptance of the deposit as premium and final issuance of the policy is subject to the underwriting norms and discretion of the insurer whose policy you have chosen to buy, and upon which Troth Insurance has no control. Troth Insurance will ensure that the amount is refunded by the insurer in case there is no ultimate issuance of a policy.

In consideration of your use of the site, you represent that you are of legal age to form a binding contract and are not a person barred from receiving services under the laws of India or other applicable jurisdiction and will only use the site to make legitimate purchases for you or for another person for whom you are legally authorized to act (and will inform such other persons about the Terms of Usage – ToU and/or Privacy Policy) that apply to the purchase you have made on their behalf (including all rules and restrictions applicable thereto). You also agree to provide true, accurate, current, and complete information about yourself as prompted by the site. If you provide any information that is untrue, inaccurate, not current or incomplete (or becomes untrue, inaccurate, not current or incomplete), or Troth Insurance has reasonable grounds to suspect that such information is untrue, inaccurate, not current or incomplete, Troth Insurance has the right to suspend or terminate your account and refuse any current or future use of the site (or any portion thereof). If you use the site, you are responsible for maintaining the confidentiality of your account and password, and for restricting access to your computer. You agree to accept responsibility for all activities that occur under your account or password.

By visiting our website and accessing the information, resources, services, products, and tools we provide, you understand and agree to accept and agree to the following terms and conditions as stated in this policy (hereafter referred to as ‘User Agreement’), along with the terms and conditions as stated in our privacy policy (please refer to the Privacy Policy section below for more information).

This agreement is in effect since April 01, 2021.

We reserve the right to change this User Agreement from time to time without notice. You acknowledge and agree that it is your responsibility to review this User Agreement periodically to familiarize yourself with any modifications. Your continued use of this site after such modifications will constitute acknowledgment and agreement of the modified terms and conditions.

2.1 Responsible Use and Conduct:

- In order to access our resources, you may be required to provide certain information about yourself (such as identification, contact details, etc.) as part of the registration process, or as part of your ability to use the resources. You agree that any information you provide will always be accurate, correct, and up to date.

- You are responsible for maintaining the confidentiality of any login information associated with any account you use to access our resources. Accordingly, you are responsible for all activities that occur under your account(s).

- Accessing (or attempting to access) any of our resources by any means other than through the means we provide, is strictly prohibited. You specifically agree not to access (or attempt to access) any of our resources through any automated, unethical, unauthorized or unconventional means.

- Engaging in any activity that disrupts or interferes with our resources, including the servers and/or networks to which our resources are located or connected, is strictly prohibited.

- Attempting to copy, duplicate, reproduce, sell, trade, or resell our resources is strictly prohibited.

- You are solely responsible for any consequences, losses, or damages that we may directly or indirectly incur or suffer due to any unauthorized activities conducted by you, as explained above, and may incur criminal or civil liability.

- We may provide various open communication tools on our website, such as blog comments, blog posts, public chat, forums, message boards, newsgroups, product ratings and reviews, various social media services, etc. You understand that generally we do not pre-screen or monitor the content posted by users of these various communication tools, which means that if you choose to use these tools to submit any type of content to our website, then it is your personal responsibility to use these tools in a responsible and ethical manner. By posting information or otherwise using any open communication tools as mentioned, you agree that you will not upload, post, share, or otherwise distribute any content that:

• Is illegal, threatening, defamatory, abusive, harassing, degrading, intimidating, fraudulent, deceptive, invasive, racist, or contains any type of suggestive, inappropriate, or explicit language; - Infringes on any trademark, patent, trade secret, copyright, or other proprietary right of any party;

- Contains any type of unauthorized or unsolicited advertising;

- Impersonates any person or entity, including any employees or representatives of Troth Insurance Broking & Consulting Pvt. Ltd.

- We have the right at our sole discretion to remove any content that, we feel in our judgment does not comply with this User Agreement, along with any content that we feel is otherwise offensive, harmful, objectionable, inaccurate, or violates any Third-Party copyrights or trademarks. We are not responsible for any delay or failure in removing such content. If you post content that we choose to remove, you hereby consent to such removal, and consent to waive any claim against us.

- We do not assume any liability for any content posted by you or any other Third-Party users of our website. However, any content posted by you using any open communication tools on our website, provided that it doesn’t violate or infringe on any Third-Party copyrights or trademarks, becomes the property of Troth Insurance, and as such, gives us a perpetual, irrevocable, worldwide, royalty-free, exclusive license to reproduce, modify, adapt, translate, publish, publicly display and/or distribute as we see fit. This only refers and applies to content posted via open communication tools as described, and does not refer to information that is provided as part of the registration process, necessary in order to use our Resources. All information provided as part of our registration process is covered by our privacy policy.

- You agree to indemnify and hold harmless Troth Insurance and their directors, officers, managers, employees, donors, agents, and licensors, from and against all losses, expenses, damages and costs, including reasonable attorneys’ fees, resulting from any violation of this User Agreement or the failure to fulfill any obligations relating to your account incurred by you or any other person using your account. We reserve the right to take over the exclusive defense of any claim for which we are entitled to indemnification under this User Agreement. In such event, you shall provide us with such cooperation as is reasonably requested by us.

2.2 Limitation of Warranties:

- The use of our resources will meet your needs or requirements.

- The use of our resources will be uninterrupted, timely, secure, or free from errors.

- The information obtained by using our resources will be accurate and reliable, and

- Any defects in the operation or functionality of any resources we provide, will be repaired or corrected. Furthermore, you understand and agree that:

- Any content downloaded or otherwise obtained through the use of our resources is done at your own discretion and risk, and that you are solely responsible for any damage to your computer or other devices for any loss of data that may result from the download of such content.

- No information or advice, whether expressed, implied, oral or written, obtained by you from Troth Insurance or through any resources we provide shall create any warranty, guarantee, or conditions of any kind, except for those expressly outlined in this User Agreement.

2.3 Limitation of Liability:

2.4 Termination of Use:

2.5 Governing Law:

2.6 Guarantee:

2.7 Nominee Assistance Program:

- Troth Insurance has merely partnered with various Third-Party experts in order to facilitate extended services to the users purchasing Term Insurance. The services provided by the Third Party(s) are provided by them in their capacity as an independent service provider(s). Troth Insurance do not provide the services in any capacity whatsoever. Troth Insurance do not endorse the services of the listed partners. Troth Insurance shall not be liable for any payment obligation in relation to the services provided under the nominee assistance program.

- Troth Insurance shall not be liable for any act(s) / omission(s) of the partners and / or any defect / deficiency in provision of the listed services including their refusal to provide the services. Any Third-Party facility / offer(s) / service(s) / product(s) (‘offer’) shall be subject to the terms and conditions of such Third Party which shall be applicable to the user. Troth Insurance do not endorse, make no representation and shall have no liability or obligation whatsoever in relation to such Third-Party offer.

- All such Third-Party offer shall be availed by user at their own risk and responsibility. Troth Insurance shall not be liable for any payment obligation in relation to such Third-Party offer, which shall be user’s responsibility.

- Troth Insurance is only an insurance broker and can assist with any insurance claims only to the extent of lesioning with the insurance company. Any insurance claim shall be processed by the insurance company subject to their terms and conditions and the insurance policy.

- Troth Insurance reserves the sole right to modify, amend, change, refuse or revoke their respective services, any offers including Third Party offer herein at any time without assigning any reason and without any liability and notice.

- These terms and conditions for Nominee Assistance Program are in addition to all other terms and conditions provided hereunder including the FAQs and all these terms and conditions and FAQs are legally binding on the user. Troth Insurance reserves the sole right to modify, amend, change or revoke these terms and conditions including the FAQs without any notice at any time and all such terms and conditions and FAQs as amended from time to time shall be legally binding on the user.

- Any disputes arising pursuant to these terms and conditions are subject to the exclusive jurisdiction of state in Ahmedabad.

2.8 NDNC:

2.9 Email Opt-out:

2.10 Security

2.11 Intellectual Property Policy:

- Troth Insurance Brokers & Consultants Pvt. Ltd. (the ‘company’) has an efficient Intellectual Property Policy and Intellectual Property Management guidelines (Collectively referred to as “IP Policy”, hereinafter) in place basically to maintain absolute clarity on IPR related issues such as ownership, rights and obligation of employees and Company, rights and obligation of customers and Company, disclosure of work/ invention, non-disclosure of confidential information, liabilities in case of misappropriation of IP or resolution of IP related disputes strategically.

Intellects Property (IP) is one of our most valuable assets. We rely on various types of intellectual properties (such as trademarks, patents, copyrights, trade secrets, domain names, design rights, etc.) for our success in the market. IP helps us stay competitive, allows us to fund future successes, and supports each of our jobs at the Company. The Company has a consistent policy of identification of Company’s intangible assets, prioritizing them according to Company’s business plans, registering, exploiting and safeguarding them in order to benefit fully from IP in terms of revenue, reputation and market share. The Company’s IP Policy also envisages protection and management of its own IP well, internally and with its business partners. We also want to respect the IP of others as we develop our products and services, run our business, and work with business partners.

For clarifications, the term Company wherever used under this IP policy, shall include its subsidiaries and affiliates.

Purpose

The Company has adopted this Policy in order to protect its own IP and minimize the possibility of infringement of intellectual property rights of the Company and the Third Parties. This IP policy aims to provide transparent administrative system for the ownership, control and transfer of the IP created and owned by the Company.

Applicability

This IP Policy is applicable to all the employees, representatives and agents of the Company including its subsidiaries and affiliates.

Policies, Procedures, and Records

• Company shall respect intellectual property (IP) and conduct its business in compliance with the IP-related laws as applicable in the jurisdiction of Republic of India and its agreements with other companies.

• Company shall actively protect its own IP.

• Company shall maintain an effective system of IP asset management, including maintaining an inventory and records of IP-related assets and agreements.

• Company shall not knowingly infringe a Third Party’s intellectual property in its products, services, or components, or disclose or use a Third Party’s trade secrets without the express or implied consent of the owner or as permitted by law.

• Company shall not knowingly purchase or use counterfeit or other infringing goods and services in running its business, including counterfeit trademark goods or infringing copyright material (such as software, publications, video, audio, or other content).

• Company shall document and maintain written records of all substantial transactions and uses that involve the exercise of IP rights. (This includes, for example, licenses or assignments of rights; manufacture, reproduction or distribution of patented, trademarked or copyrighted items; and disclosure and use of trade secrets.)

• Company shall require, through binding policies or agreements with employees and contractors that its personnel comply with the applicable IP laws and the Company’s IP policies and IP-related provisions in agreements with other companies.

• Company shall develop and implement a management system to help ensure that all personnel follow its IP policies. This management system shall encompass all IP-related policies, procedures and adequate and accurate records necessary to implement, measure, and improve Company’s IP protection and compliance program.

IP Compliance Team

Company’s IP protection and management shall be implemented through a cross-functional compliance team, overseen by a Director or CFO of the Company or designated senior management. The said compliance team may appoint or engage any advocate or expert from within and/or outside the Company to seek their opinion in carrying out their responsibilities as stated under this IP Policy.

Scope and Quality of Risk Assessment

Company shall include in its risk assessment of new products, services, and business opportunities, any relevant IP protection risks.

Management of Business Partners:

• Company shall require its business partners to conduct their arrangements with the Company in accordance with Company’s relevant IP protection policies.

• Company shall conduct initial risk assessment and due diligence on all prospective business partners, which shall include an assessment of such companies’ IP protection and management.

Security and Confidentiality Management

• Company shall maintain physical security designed to effectively protect trade secrets (where applicable) and other confidential information, and IP-related records, masters, tools, inventory and related materials.

• Company shall maintain computer and network security effective for protecting trade secrets, other confidential and proprietary information, and IP related records, and for discouraging violations of Company’s IP policies on the Company’s computers and networks.

• Company and its personnel shall only make trade secrets and other proprietary information available to third parties on a ‘need to know’ basis, and subject to company procedures and written agreements containing adequate confidentiality and other protections.

• Company shall execute written ‘Confidentiality or Non-disclosure Agreements’ with Third Parties prior to disclosure of any confidential information of the Company to any Third Party(ies).

• Any IP generated, created or developed by any of the employees/representatives and agents of the Company and/or consultants engaged by the Company, during the term of their employment or engagement as the case may be, for and/or on behalf of the Company, shall be ‘work made for hire’ and shall be assigned by such persons to the Company. Further, the Company shall have the sole and exclusive ownership to such IP generated, developed or created unless otherwise agreed by the Company by way of a written contract or as may be applicable by the relevant IP law.

2.12 IP Licensing and Transfer:

- The Company may license its IP to any of its Subsidiaries, Affiliates or a Third Party(ies) through various modes of Licensing strategy such as: Exclusive Licensing, Sole Licensing, Non-Exclusive Licensing, Sub-Licensing and Licensing in general. The Company shall document such IP licensing through a license Agreement where each such license agreement shall define the terms and conditions for the proper use of IP of the Company.

- The Company may transfer its IP to any of its Subsidiaries, Affiliates or a Third Party(ies) through a signed IP transfer agreement on the conditions as may be deemed to be fit and proper to the Company.

2.13 Disclaimer:

- Troth Insurance intends to offer clean and impartial information about insurance products and services. The information and data are generic in nature. Our efforts are to provide impartial, accurate, and responsible data to the best of our ability. We are, however, in no manner or form responsible for any discrepancies inside the information posted on our website.

- There isn’t any intention or purpose of violating any intellectual property or ancillary rights. All information supplied at the portal Troth Insurance is a challenge to its discretion and is likely to change without any notice. Though, any modifications in public utility will be communicated on our portal.

- Although we’ve attempted to maintain high standards in quality, clarity, and accuracy of the material published at the portal, Troth Insurance isn’t legally accountable for the same in any way whatsoever.

- Employees, partners, and related groups of workers of Troth Insurance aren’t accountable for any loss, damage, or harm that occurs or may occur or arise or from the use of information from the portal. Customers are advised to apply their own discretion in such matters.

- It is important to understand that insurance is a subject matter of solicitation and market risks. It is responsibility of the customer to understand the limitations of insurance policies and risks involved, and under no circumstance, form or manner, do we take any liability in such cases. We also recommended you to please read the subject and offer documents carefully. The information supplied at the portal are for financial and insurance purposes.

• It is mutual understanding between us and the customers that their association with the portal will be at their sole discretion and risk. - You hereby agree and verify that you will be solely responsible for authenticity of the document uploaded here. We are acting only as a facilitator and claim acceptance or rejection is at the sole discretion of the insurer.

- Visitors to this website/portal and every Third Party is hereby informed that the owners of this website/portal, viz., Troth Insurance Broking and Consulting Pvt. Ltd. are insurance brokers working for various insurance companies (insurers) whose products are dealt with in this website / portal.

- • Though endeavor is made to make correct policy/product comparisons, quotes, features, etc., based on the information provided by the insurers, it is made abundantly clear that Troth Insurance Brokers & Consultants Pvt. Ltd. its directors, shareholders, officers, and employees and wwww.troth.co.in are in no way responsible to or liable for anyone for his/her investment decision, and every prospect policyholder shall be solely responsible for the consequences of his/her decision.

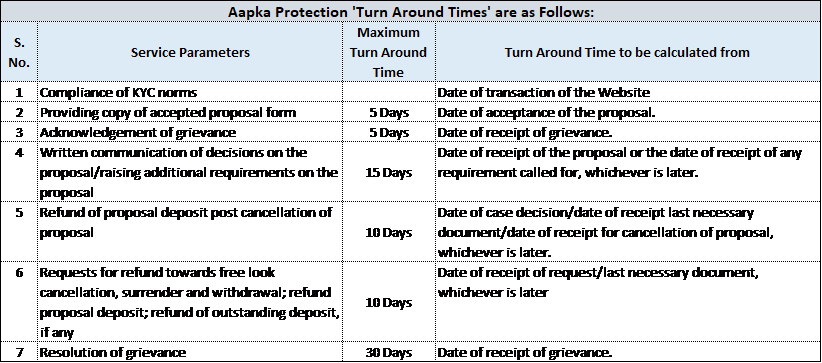

2.14 ISNP Service TAT – Health:

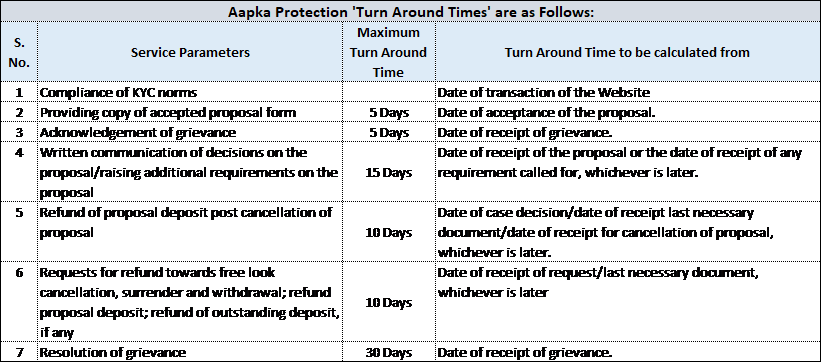

2.15 Service TAT – Life:

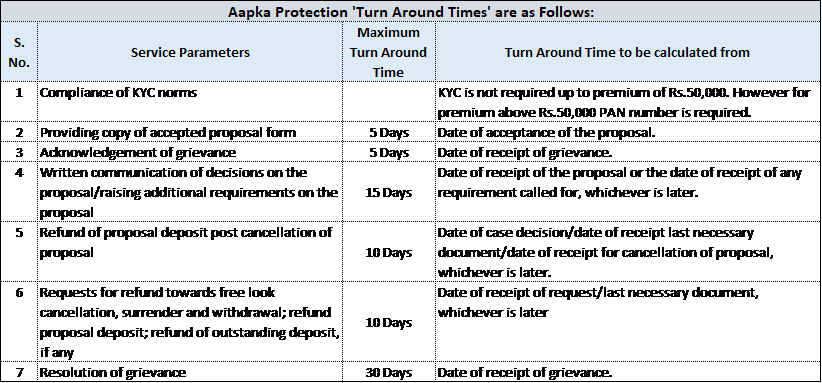

2.16 Service TAT - Motor, Two-Wheeler & Travel

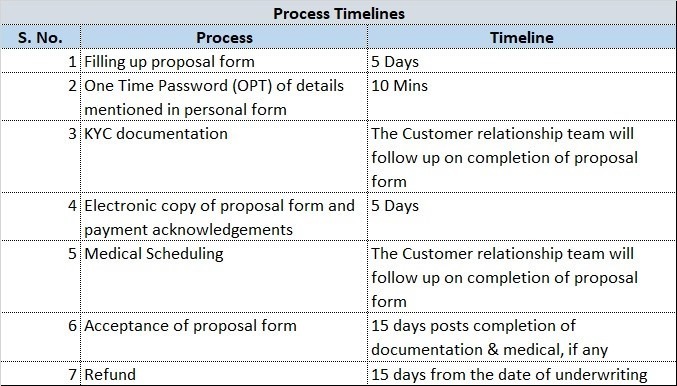

2.17 Procedure & Processes:

Health Insurance: Procedures, processes, and timelines of post-sales servicing (according to schedule III of insurance e-commerce guidelines). This document has detailed information on the procedures, processes, and timelines for post sales servicing. If in case, you need to avail of any of those services, you can achieve this via way of means of sending your request at our e-mail info@troth.co.in out of your registered e-mail id.

• Issuance and Crediting of the Policy Document / Certificate of Insurance / Proposal form.

Turnaround time is 15 calendar days from the date of receipt of entire documents.

• Organizing medical checkups and submission of medical reports

Medical checkups are required by the Insurers in line with the plan that the customers has procured. If the plan requires a medical checkup –once customer has made the payment of recently purchased online plan, he/she could be routed to complete the following steps i.e., schedule medical (if relevant).

• Issuance of endorsement:

An endorsement is issued to the policyholder whenever any contractual modifications (authorized by plan/policy) are requested by policyholder, – accepted by the insurer and made in the policy. Please refer with sections (d), (g), (l), and (n) of this document for types of modifications and their respective documentation.

The turnaround time is 15 business days from the date of receipt of the complete document.

Change of Policy Terms and Conditions/Details Change:

• Correction of Date of Birth (DOB): Change of DOB request means a change or correction in the Date of Birth of the policyholder, lifestyles insured or nominee/trustee.

Documents required to perform the request are:

Date of Birth Proof

• Additional Premium (anywhere relevant because of extruding of DOB)

The turnaround time is 15 business days from the date of receipt of complete documents

• Increase in sum assured / decrease in sum assured: As in line with the policy contract, this transaction is allowed only at the time of renewal.

Documents required to carry the request are:

• Change Request form (wherever applicable)

• Premium (wherever applicable)

• Medicals (wherever applicable)

The turnaround time is 15 business days from the date of receipt of the complete document.

• Correction of Gender: Change in gender means of updating of correct gender in Customer’s Policy.

Documents required:

• ID Proof wherein DOB needs to fit with our information.

• Premium (wherever applicable due to change of Gender).

• The turnaround time is 10 business days from the date of receipt of complete documents.

Change of Name/Address

• Change of name: If in case, you need to place request for change of name, you are requested to submit below referred to requirements.

Documents:

• A valid name change proof (on which customer’s DOB need to fit with our records) DOB Proof needs to be in DD-MM-YY order

• Name Change Affidavit (as per state value) attested by first elegance magistrate

The turnaround time is 15 business days from the date of receipt of complete documents.

• Change of address: If in case, you want to place request for change of address, you are requested to submit below mentioned requirements.

Documents:

- Self-Attested valid address Proof of new address

Turnaround time is 15 business days from the date of receipt of complete documents

Life Insurance: Procedures, processes and timelines for Pre- Sales solicitation of insurance policies.

- E-Quote generation on the digital platform:

The E-Quote for a customer is generated once he/she fills up the basic details like DOB, gender, smoker/non-smoker, cover amount, personal details – name, mobile, email ID.

- Plan Selection & Redirection to Product page:

Upon E-Quote generation customer can check the quotes from various insurance companies and select any insurance company’s plan that the customer wishes to purchase, he will then be redirected to product page for that insurer which lists down all the details of the plan selected and gives option to select riders.

- Redirection to Payment Gateway:

Customer is redirected to the payment gateway (PG) page and premium payment is made by him/her. Customer has various payment options to pay the initial premium at the time of application for example – through internet banking, debit card, credit card and wallets. These options are available on the payment page of the proposal form journey on our website. This might change from time to time. Apart from this, standing instruction option is also available to pay future renewal premiums. Once customer has made the payment online, he/she would be directed to complete the next steps i.e., fill Proposal form, Upload Documents & Schedule Medical (if applicable). For any income associated queries, the patron can name us on 1800-2333-2333

Life Insurance: Procedures, processes and timelines for Post Sales servicing of insurance policies

Filling up the proposal form:

Underwriting of insurance proposals is done basis the disclosures by the life insured/proposer in the proposal form, hence it is mandatory to verify the details filled in the proposal form and authenticate them through OTP (One-time password) authentication.

On completion of payment and proposal form filling, a copy of proposal form (PDF) along with payment acknowledgment will be sent to the customer’s registered email ID.

The proposal form journey consists of below sections:

- Personal Details – This section contains details like name, contact details, education, and nationality

- Employment details– This section contains details like employment like salaried / self-employed, name of employer, designation, income

- Address Details – This section contains details like Address, City & Pin Code.

- Insurance history – This section contains details on any other insurance cover

- Nominee details – This section contains details on nomination like name, relation

- Lifestyle & well-being – This section contains details like height, weight, travel & adventure

- Health– This section contains details regarding medical disclosure on any previous investigations, diagnosis or treatment

- OTP (One-time password) authentication – Customer needs to enter the OTP to authenticate the details provided in the proposal form. OTP is sent on customer’s mobile & email with a validity of 30 minutes.

- Review & acceptance – This section contains details of all the information filled up in previous sections for easy review and acceptance of proposal by the customer.

Document Upload:

In upload documents section, customer has to upload self-attested copy of below mentioned documents:

- Photograph

- Address proof (communication & permanent address)

- Identity proof

- Income proof

Schedule Medicals:

In schedule medical section, the customer needs to select a preferred date and time for medicals. The medicals can either be at customer’s residence or he / she will be required to visit the insurer’s empaneled diagnostic centers. Details of these are available on schedule medical page and in case of any changes, customer will be informed accordingly.

Policy underwriting & decision of policy issuance is made by the insurer. Once the policy is issued, policy pack will be sent to customer at his / her communication address as selected on the proposal form by the insurer but the soft copy of the issued policy shall be sent to customer’s email ID by Troth Insurance.

Change of Policy Terms and Conditions/Details Change

Correction of Date of birth: Change of DOB request means a change or correction in the Date of birth of the policyholder, life insured or nominee

Documents required:

- DOB change form (for all policy numbers)

- Self attested Date of Birth Proof

- Premium (wherever applicable due to change of DOB)

- Revised Illustration duly signed

Turnaround time is 10 days from the date of receipt of complete documents

Collection of renewal premiums and remittance to insurers:

- Select the insurer for which you wish to pay the renewal premium.

- Input policy number for which premium is due.

- Enter DOB of the life insured.

- Pay amount due on the Payment Gateway through internet banking, debit card, credit card

Receipt for renewal payment will be sent to register Email Id in 2 days from date of transaction. For any carrier associated queries, the customer can touch us on 1800-2333-2333 or email us at info@troth.co.in

Motor & Two-Wheeler: Procedures, processes and timelines of post-sales servicing.

This document has detailed information on the procedures, processes and timelines for post sales servicing. If in case, you want to avail any of these services, you may do so by:

Sending your request at our email id, Info@troth.co.in from your registered email id.

• Issuance and crediting of the Policy document / Certificate of Insurance / Proposal form

The turnaround time for issuance and crediting of policy is 7 (seven) calendar days from the date of receipt of complete documents by the Insurer.

- Organizing inspection and submission of video inspection report:

Once customer has made the payment of the purchased online plan, he/she would be routed to complete the next steps i.e., Schedule an Inspection (if applicable).

- Issuance of endorsement

An endorsement is issued to the policyholder whenever any contractual changes are accepted and made in the policy. Please refer to below sections of this document for types of changes and their respective documentation

The turnaround time is 15 (fifteen) calendar days from the date of receipt of complete documents by the Insurer.

Change of Policy Terms and Conditions/Details Change

Correction of Date of Birth (DOB): Change of DOB request means a change or correction in the Date of Birth of the policyholder, life insured or nominee / Trustee.

Documents required:

- DOB change form (for all policy numbers)

- Self attested Date of Birth Proof

- Premium (wherever applicable due to change of DOB)

- Revised Illustration duly signed

Vehicles details change

- Registration Certificate (RC)

- Premium (wherever applicable due to change in NCB, IDV, Ownership transfer, CC Fuel type, CNG addition, MFG year, Legal liability for paid driver & model and variant).

The turnaround time is 15 (fifteen) calendar days from the date of receipt of complete documents by the Insurer.

Effective date of coverage change:

As per contract. A customer can change on the basis of previous year policy

Documents required:

- Previous year policy

Turnaround time is 15 calendar days from the date of receipt of complete documents

Change of Name/Address

Change of name: If in case, you want to place request for change of name, you are requested to submit below mentioned requirements.

Documents:

- RC Copy

- Previous year policy copy

Change of address: If in case, you want to place request for change of address, you are requested to submit below mentioned requirements

Documents:

• Self-Attested valid address Proof of new address

2.18 Change of Nomination:

As per policy contract, policyholder may nominate any other person, to whom the money secured under the policy shall be paid in the event of death of the policyholder. If in case, you want to place request for change of nominee, you are requested to submit below mentioned requirements

Documents required:

- A request letter duly signed by the policyholder, mentioning the new nominee’s name

- Email from registered email id stating name of nominee and relation

Turnaround time is 15 calendar days from the date of receipt of complete documents by the Insurer.